Kenya’s eCommerce market has made significant strides over the last few years. Several factors, including the country’s adoption of a digital economy blueprint, have boosted Kenya’s eCommerce market.

Increased internet penetration and smartphone usage have also played pivotal roles in online transactions, as more and more Kenyans are purchasing their products using mobile bank accounts.

Combine the government's ambition for universal 5G coverage alongside growing smartphone usage and you have the recipe for one of the fastest growing eCommerce markets on the continent.

Both B2B and B2C, are taking advantage of the growing market and establishing their business in Kenya.

Exploring Kenya’s Surging eCommerce Market

Discover the trends behind Kenya’s eCommerce boom: Insider statistics and market insights

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| In 2023, eCommerce user penetration will hit 46.7%. By 2027, that figure is estimated to reach 63.9%. | |

| Approximately 24% of the population bought at least one product from an online platform in 2021. | |

| Revenue in eCommerce is expected to show an annual growth rate (CAGR 2023-2027) of 6.03%, with a projected market volume of US$3,527.1 million by 2027. | |

| Total transaction value in the Digital Payments market is projected to reach US$8,508.00m in 2023. | |

| Electronics and media is the largest market in Kenya, accounting for 41.8% of eCommerce revenue. Fashion is the second largest market accounting for 34.3% of revenue. |

| The average revenue per user (ARPU) in Kenya’s eCommerce market is expected to be US $108.70 in 2023. | |

| The number of users in the eCommerce market is expected to reach 38.07 million by 2027 — an overwhelming majority of the current population of 55 million. | |

| In 2023 Kenya's internet penetration rate stood at 32.7%. | |

| The number of social media users in Kenya was equivalent to 21.1% of the total population in 2022. | |

| The credit card penetration in Kenya is forecast to continuously increase between 2023 and 2028 to 10.1%. |

-

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

-

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

-

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

-

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

-

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

-

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

MassPay’s Hyper-Localized Payment Solution

MassPay prioritizes flexibility and security, offering hyper-localized payment options to ensure customers can pay the way they prefer. We offer a broad range of payment options including online bank transfers, mobile wallets and prepaid cards.

MassPay is a reliable option for merchants looking to expand their business into Kenya’s eCommerce market. Our solutions provide eCommerce merchants with comprehensive payment options and services to get them up and running quickly.

Rest assured, when customers pay through an eCommerce platform powered by MassPay, their data is encrypted and stored on local servers to increase security and reduce the risk of fraud.

We also offer a range of payout solutions including mobile wallets, prepaid cards, and online banking transfers, to ensure your payees get the best experience possible.

Create New Revenue Streams in Kenya’s eCommerce Market with MassPay

Kenya offers untapped opportunities in eCommerce. Our integrated platform eliminates the complexity of dealing with multiple third-party providers, giving merchants control over a fully optimized sales strategy.

Ready to efficiently navigate this burgeoning market?

Rely on MassPay for:

Single-point integration to sidestep the challenges of managing multiple payment gateways

Ultimate sales strategy control with the tools to craft and execute a tailored sales approach

Let MassyPay process payments while you focus on the core components of your business. Our platform offers you the capacity to adapt to the unique payment preferences in Kenya.

Payment preferences (in local currency)

Your customers expect payment options to match local preferences.

MassPay recognizes the value of providing local currencies to build stronger relationships with consumers, employees and partners. Whether it’s Kenyan shillings (KES), US dollars (USD), or any other locally preferred alternative, MassPay has you covered.

Security and state-of-the-art technology

The Kenyan government has made it a priority to grow the country’s digital infrastructure. As more Kenyans adopt preferences for online shopping there is a need to ensure consumers are protected from threats.

MassPay boasts state-of-the-art security measures to protect businesses from fraud and losses due to chargebacks or failed payments. We use advanced encryption technology for data protection and complies with the highest security standards.

Payouts

Merchants can send payouts to customers efficiently with MassPay’s end-to-end payment services. Eliminate long wait times that slow down your business, Help your customers receive payments in their choice of local currency instantly and securely.

Optimized payment processing

Ensure seamless payment processing with MassPay. Accept customer payments quickly and securely, and increase your leverage in Kenya’s eCommerce market.

Kenya’s Payment Market

Kenya can be the key to entering the African market. As the seventh most populous country on the continent, Kenya offers considerable opportunities for businesses looking to expand their operations. By understanding the local payment landscape, building comprehensive strategies and leveraging the latest fintech trends, you can find success in this growing market.

MassPay provides hyper-localized payment orchestration solutions tailored to your needs, ensuring seamless integration and optimizing your payment and payout strategies.

Download The Complete Guide to Payout Orchestration (URL) to discover how MassPay's cutting-edge technologies and trends can help you streamline your payout processes and optimize your payment strategy.

Get ready to revolutionize your payments in Kenya with MassPay!

Kenya’s Payment Methods

Offering the preferred payment methods will help you reach a broad customer base in Kenya.

Global Payouts

Built for the Gig Economy.

Give your talent flexibility & full control of their funds with payouts on demand in 175+ countries & 70+ currencies.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including crypto.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Simplify Administration

Say goodbye to complexity. We take care of accounting & reconciliation details and more. You focus on growing your platform.

No More Tax Forms

Your talent is global. We take care of the 1099 & 1042 process for you. You focus on growing your platform.

Reward Your Talent

Help them grow their business.Incentivize quality and increase completion rates.Postdate payments until customers are happy.

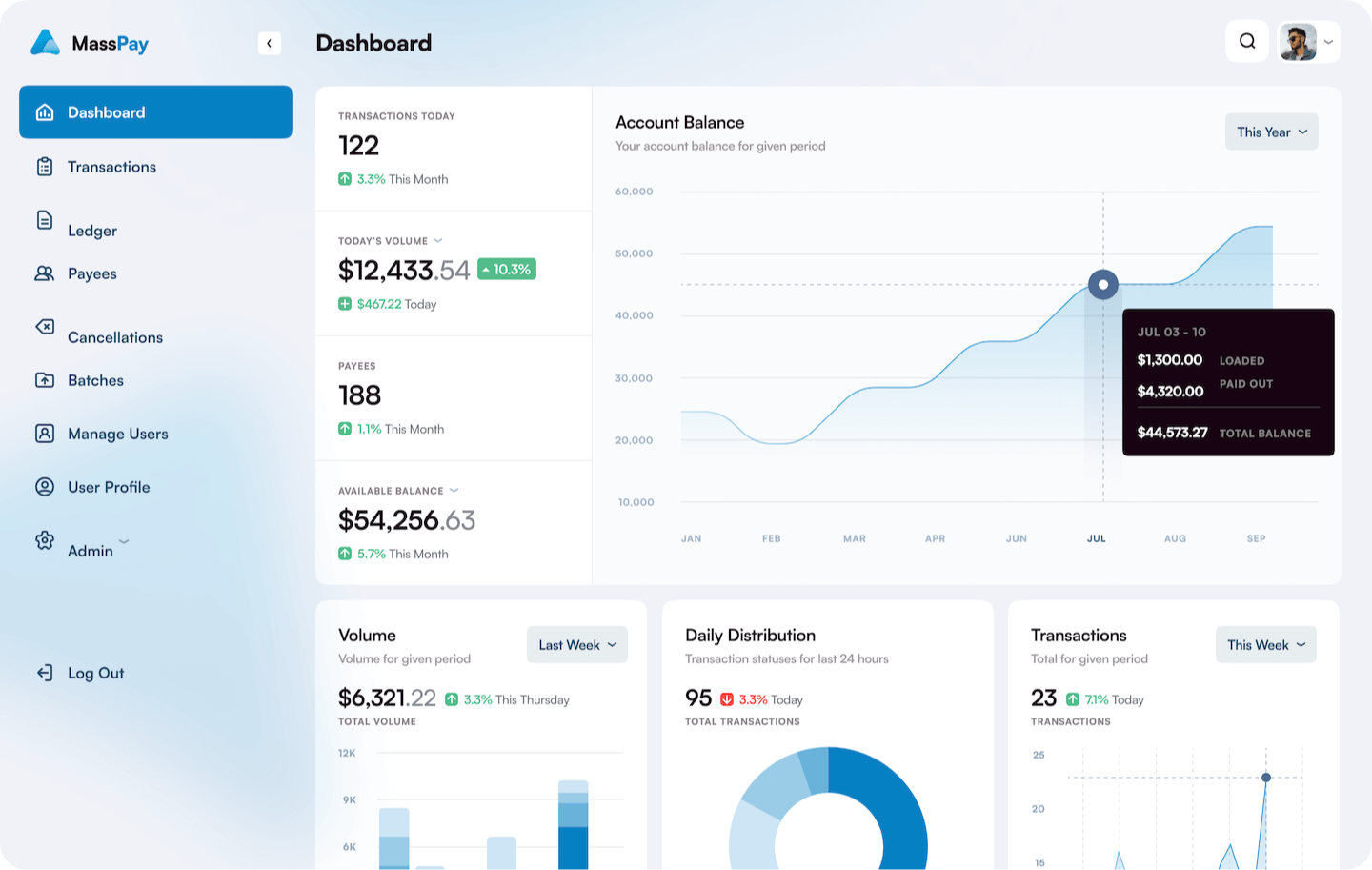

SINGLE PANE OF GLASS

FOR YOUR PAYOUT OPERATIONS

All of your payout operations are accessible from an easy to access, easy to use dashboard that is available wherever you are with whatever device(s) you prefer.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Bank transfers

![]()

One of the most popular payment methods in Kenya are bank transfers. As more Kenyans become integrated with banking institutions, consumers are taking advantage of the option to make payments for e-commerce purchases directly from their bank account.

Digital wallets

![]()

Digital wallets, or e-wallets make digital payments more convenient and secure across Kenya.

The push for digital transformation is providing Kenyans with a convenience and accessible option for making payments.

Direct Pay Online (DPO)

![]()

Direct Pay Online (DPO) has been operating across Africa. This online payment method allows customers to pay with their currency of choice, via Direct Pay Online.

DPO offers mobile money transfers and an option to add debit and credit cards.

Mobile Money Services (MMS)

![]()

![]()

Mobile money services like M-Pesa have become widely used in Africa. These have become a preferred solution for unbaked populations due to its convenience. With more and more of the population using smartphones, mobile services have become a gateway to online purchases.

A bank account is not required for MMS. It works as a pay-as-you-go medium using your mobile bank account.

Credit cards

![]()

![]()

Credit card usage has steadily grown in Kenya. From 2023 to 2028, credit card penetration will have increased for five consecutive years to reach 10.1%.

MassPay’s platform is equipped to process card payments, including Visa and Mastercard.

Cash on delivery (COD)

![]()

Cash on delivery is one of the most popular online payment types in Kenya. This payment method facilitates cash payments to the delivery person upon receiving their product.

COD has become a primary method for many new online users. It is a secure method for customers who don’t feel comfortable entering their card details or making a digital wallet payment.

Kenya Payout Options

MassPay’s comprehensive end-to-end services help you streamline payments. Wave goodbye to frustrating delays and hello to swift and secure payments in the local currencies. Our localized payout options ensure your customers receive money using the methods which work for them.

Payout Options

Payout Processing With International Settlement

Payout Processing With Domestic Settlement

Cash pickup

![]()

![]()

Cash pickup is one of the most popular payout options in Kenya. This method of money transfer lets the receiver pick up cash from partner locations including Kenya Commercial Bank, Kenya Post Office Savings Bank, and SBM Bank.

Cash pick is commonly used for recipients who may not have access to bank accounts or other digital payment methods.

Mobile Money Services

![]()

![]()

Leverage mobile money platforms like M-Pesa and Airtel Money to send money to the top cash pickup locations and banks in Kenya. Payouts can be received as mobile money balances and withdrawn as cash or used for other transactions.

Direct bank transfer

![]()

Another common payout option is the direct bank transfer. This method offers a secure and efficient way to move money between accounts and eliminates the need for physical cheques.

MassPay helps you make bank deposits to all major banks, including Equity Bank.

Online payment platforms

![]()

Utilize online payment platforms to send money electronically. MassPay leverages platforms and links to bank accounts, credit cards and digital wallets.