Welcome to the vibrant world of South Africa’s eCommerce and payment landscape! Digital innovation and economic growth revolutionize how people shop, transact, and do business. As one of Africa’s leading economies, South Africa boasts a dynamic online market catering to a tech-savvy population and a thriving entrepreneurial spirit—eCommerce is transforming how consumers access goods and services.

Embracing the convenience and scalability of digital payments, South Africa’s payment landscape is evolving rapidly to meet the demands of a modern and interconnected society.

South Africa’s Digital Payments Revolution

Unveiling the dynamic realm of South Africa’s eCommerce and payment landscape

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| South Africa is one of Africa’s leading economies, contributing significantly to the continent’s digital transformation. | |

| The country has a tech-savvy population, with a growing number of internet users and mobile phone owners, providing a fertile ground for eCommerce growth | |

| As of 2023, South Africa’s eCommerce market was valued at over 6.36 billion, and it is projected to reach 9.97 billion by 2027. | |

| Online retail sales in South Africa experienced an 11.9% year-on-year growth, indicating a rapid shift towards digital shopping. |

| The prevalence of digital wallets and mobile money is on the rise, with more and more consumers preferring mobile payment methods for transactions. | |

| South Africa’s most prominent eCommerce segment is fashion, followed by toys, hobby, DIY, electronics and media, furniture, and appliances. | |

| The country’s financial sector is embracing fintech innovations, with 982 startups and companies revolutionizing the payments landscape (as of July 2023). | |

| South Africa’s government and regulatory bodies are actively supporting the growth of eCommerce and digital payments, promoting a conducive environment for businesses and consumers alike. |

-

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

-

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

-

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

-

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

-

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

-

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

Be Part of the Promising Future of eCommerce and Payments in South Africa

The eCommerce and payments landscape in South Africa is expected to continue its upward trajectory, driven by ongoing digital innovation, increased internet penetration, and a consumer base eager to embrace the benefits of online shopping and secure digital transactions.

In a country where trust and convenience for payments are paramount, MassPay offers a hyper-localized payment solution. It caters to the unique preferences of South African customers while providing merchants with heightened flexibility and security.

With MassPay’s eCommerce platform, customers can choose from multiple payment options, ensuring a seamless and tailored payment experience. To bolster security and reduce the risk of fraud, customer data is encrypted and stored on local servers within South Africa, instilling confidence in online transactions.

Empowering Merchants in South Africa’s Booming eCommerce and Fintech Landscape

With MassPay’s hyper-localized transaction processing, merchants can process payments via in-region payment processors, resulting in:

Increased conversions

Improved revenue streams

Whether they’re in South Africa or the opposite corner of the world, customers want to use preferred local payment methods that are seamlessly integrated into the checkout process—this, and more, is what MassPay offers.

Payment preferences (in local currency)

With MassPay’s cutting-edge localized payment solutions, merchants can seamlessly accept South African Rand (ZAR) payments and other locally preferred alternative payment methods. Whether in the national currency or other familiar options, MassPay ensures customers can easily pay, boosting convenience and customer satisfaction.

By catering to South Africa’s payment preferences, MassPay empowers merchants to tap into the country’s vibrant eCommerce market with confidence and success.

Open API for customization

MassPay’s Open API opens doors to endless possibilities for South African merchants. Harness the power of this customizable tool to tailor payment and payout experiences, creating unique solutions or enhancing existing integrations to maximize the potential of your online business. With MassPay, the future of your eCommerce success in South Africa lies in your hands.

Secure and reliable technology

In the pursuit of building consumer trust, choosing a payment platform with robust security measures becomes paramount. At MassPay, we prioritize your peace of mind by offering a secure infrastructure and advanced fraud prevention features, ensuring the protection of your payment data and upholding the trust of your valued customers.

Comprehensive payment options for merchants

MassPay’s solution empowers eCommerce merchants in South Africa with an array of comprehensive payment options and services. This lets businesses swiftly establish their online presence, making connecting with customers easier and processing payments efficiently.

Optimized payment processing

MassPay understands the importance of a positive payment experience for merchants and their payees.

As such, the platform offers diverse payment solutions, including:

- Mobile wallets

- Prepaid cards

- Online banking transfers

The South African Payment Market

Are you ready to take your eCommerce business in South Africa to new heights? By staying at the forefront of digital payments with a hyper-localized approach, companies can tap into South Africa’s thriving eCommerce market and drive continuous growth and success in the digital era.

Try MassPay today and unlock the power of a hyper-localized payment solution tailored to South African customers.

With seamless payment options and top-notch security features, MassPay empowers merchants to optimize their payment processes, increase customer satisfaction, and stay ahead in the evolving digital landscape. Join the digital payments revolution and experience the future of eCommerce in South Africa with MassPay. Try it now!

South African Payment Methods

When you offer customers their preferred payment methods, you build trust and minimize friction in the payment process. Here are some of the top payment methods in South Africa.

Global Payouts

Built for the Gig Economy.

Give your talent flexibility & full control of their funds with payouts on demand in 175+ countries & 70+ currencies.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including crypto.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Simplify Administration

Say goodbye to complexity. We take care of accounting & reconciliation details and more. You focus on growing your platform.

No More Tax Forms

Your talent is global. We take care of the 1099 & 1042 process for you. You focus on growing your platform.

Reward Your Talent

Help them grow their business.Incentivize quality and increase completion rates.Postdate payments until customers are happy.

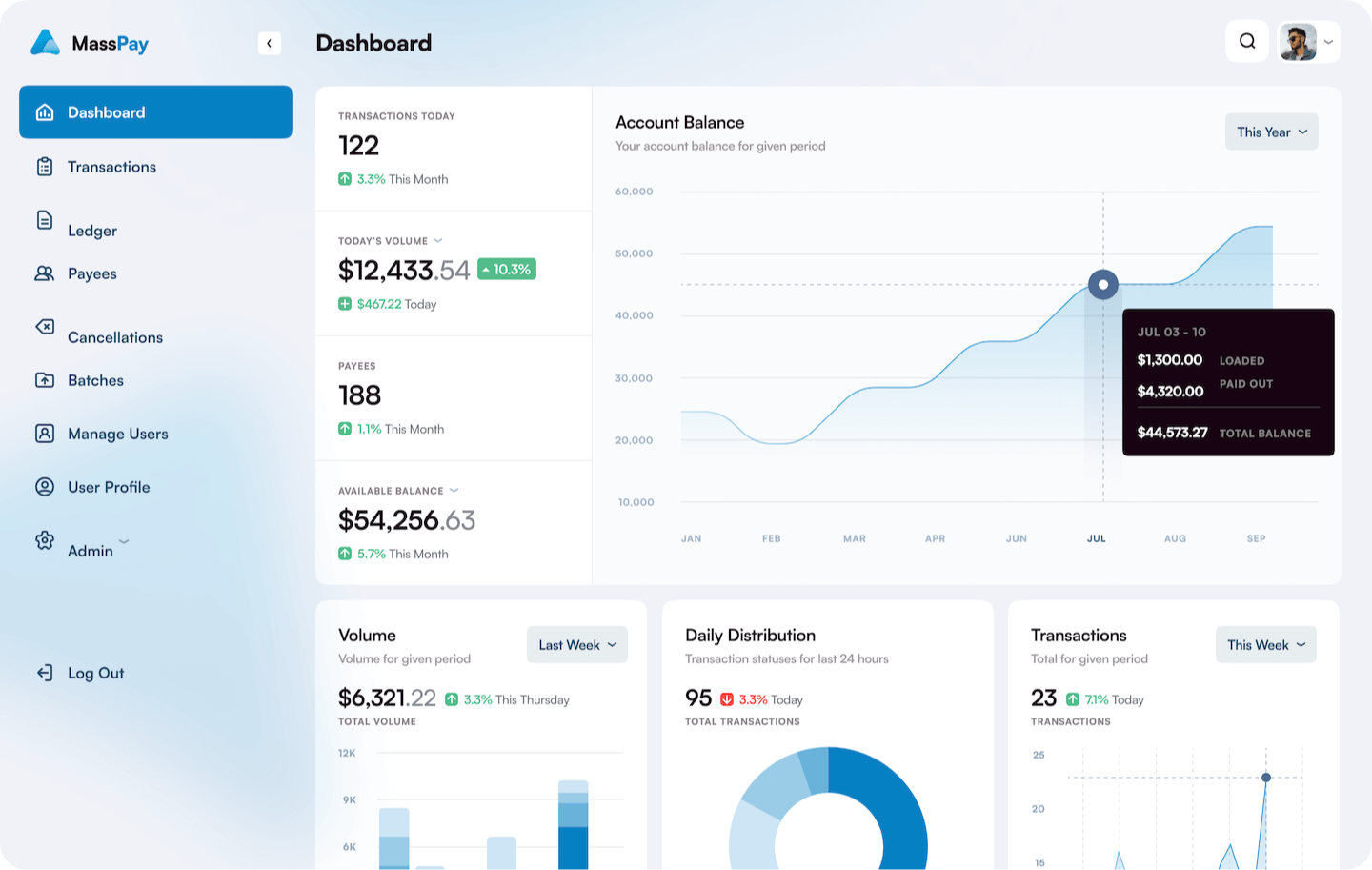

SINGLE PANE OF GLASS

FOR YOUR PAYOUT OPERATIONS

All of your payout operations are accessible from an easy to access, easy to use dashboard that is available wherever you are with whatever device(s) you prefer.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Cash

![]()

South Africa has a sizable banked population. Still, cash accounts for a significant proportion of transactions in the country.

Debit and credit cards

![]()

![]()

Debit and credit cards are commonly used for eCommerce transactions and various other purchases in South Africa. Recognized global brands like Visa, Mastercard, and American Express are accepted, along with cards issued by local and international banks.

Bank transfers

![]()

Bank transfers are also common in South Africa. For merchants, offering bank transfers as a payment option is crucial in catering to the diverse preferences of their customers.

By providing bank transfer options, merchants can enhance customer convenience and trust, encouraging more sales and fostering a positive shopping experience. Additionally, accepting bank transfers expands the merchant’s potential customer base, appealing to those who prefer the security and familiarity of direct bank transactions.

Digital wallets

![]()

![]()

Digital wallets have gained significant popularity in South Africa, presenting a convenient and secure payment solution for consumers. With local mobile apps like Snapscan, Zapper, and Masterpass, users can make quick and hassle-free payments using their smartphones at various merchants.

Offering digital wallets as a payment option is essential for merchants to tap into this tech-savvy customer base, enhance convenience, and drive customer satisfaction.

South African Payout Options

Experience the benefit of all-inclusive payment services. MassPay ensures you have all the payout options available to make swift and secure payments in local currencies. Your customers will receive money instantly, using the methods which work best for them.

Payout Options

Payout Processing With International Settlement

Payout Processing With Domestic Settlement

Direct bank transfer

![]()

Direct bank transfers are a widely used method of payment in South Africa. This option offers South Africans a safe and secure option to move money and receive payments.

MassPay helps you make bank deposits to all major banks, including First National Bank and ABSA.

Mobile money services

![]()

Mobile money platforms like MTN Mobile are a popular payout option. Not only can South Africans send and receive money, but they can also use the platform to pay bills and make purchases.

Online payment platforms

![]()

MassPay can utilize online payment platforms to send money electronically. MassPay leverages platforms and links to bank accounts, credit cards and digital wallets.