Flexible payment integration

MassPay’s API makes integrating with existing software and CRM systems easy—you can manage your international payments in one place.

China is the largest eCommerce market in the world, with sales valued at $2.2 trillion in 2023. The country contributes to almost 50% of the world’s eCommerce transactions.

Mobile payments reign supreme, accounting for over 70% of total online transactions. Card payments are also popular. In 2022, approximately 9 billion debit cards were issued, accounting for about 21% of transactions.

China's eCommerce sales skyrocketed to 13.79 trillion yuan (US $2.04 trillion) in 2022, surpassing the US by a significant margin. With more than a billion Chinese consumers shopping online via mobile devices, China’s eCommerce market is projected to grow by 9.9% in 2023.

|

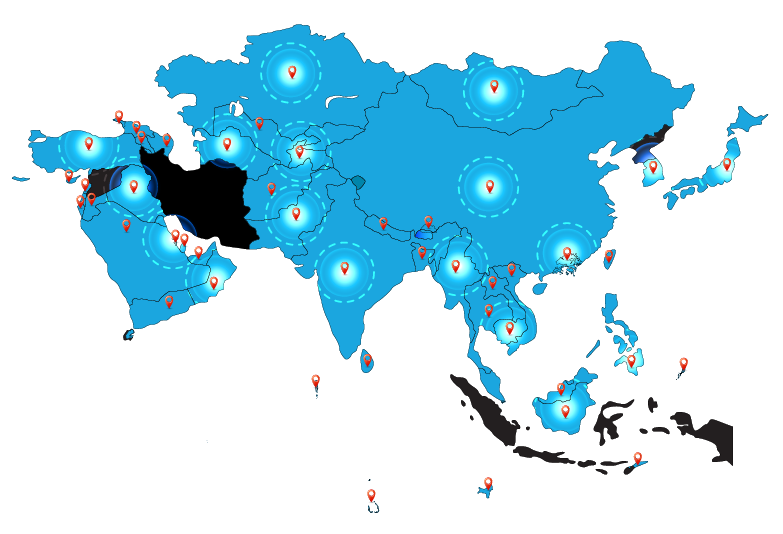

Asia's eCommerce market is one of the largest and fastest-growing in the world. Estimated growth could surpass $3.5 trillion by 2024. |

|

Asia leads the world in mobile commerce (m-commerce) adoption, with over 50% of eCommerce transactions taking place on smartphones and tablets. |

|

|

Cross-border eCommerce is on the rise in Asia, with consumers increasingly purchasing from international merchants. |

|

|

Livestream shopping has been trending. In addition, social commerce is surging thanks to the popularity of platforms like WeChat. |

Now, let’s take a look at some of the features our platform provides to make global payments simpler and more efficient.

MassPay’s API makes integrating with existing software and CRM systems easy—you can manage your international payments in one place.

Our automated process ensures payouts are sent out quickly and accurately—no need to worry about manual errors.

MassPay is designed to simplify businesses setting up a global payment plan. All you need is an internet connection and your company information.

We know how important it is for your business to be global and adaptive—that’s why we’ve built our payout platform with this in mind.

In line with our commitment to offer our clients whatever they need to succeed in competitive global markets, we also have recently introduced a comprehensive Visa debit card program tailored for both payers and payees.

Features include:

The cards carry the Visa brand, ensuring global acceptance at over 20 million merchants.

Payees have the choice of a virtual card for online shopping or a physical card for in-store purchases.

Cards are compatible with top digital wallets like Apple, Google, and Samsung.

Activation is quick, providing payees with immediate fund access. A virtual card ensures instant spending capabilities.

The program is currently available only for U.S. residents, but global options can be discussed.

Real-time fund access for payees, making finance management convenient.

MassPay allows businesses to co-brand the debit cards for an enhanced brand experience.

Furthermore, MassPay emphasizes customer support with a dedicated team of payout specialists ready to assist.