In 2022, China's eCommerce sales reached an astonishing 13.79 trillion yuan (US $2.04 trillion), hugely surpassing the US's estimated $1,034.1 billion. MassPay offers payment and payout orchestration solutions specifically designed to meet the requirements of Chinese shoppers so you can take advantage of the incredible potential in this market.

Enhance your presence in China by mastering the nuances of hyper-local payments and payouts

China's eCommerce market:

A thriving digital economy

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| In 2023, Greater China is expected to generate a revenue of US $1,487,233.0 million, making it the largest eCommerce market in the world | |

| China accounts for almost 50% of the world's eCommerce transactions | |

| Alibaba and JD.com are the two dominant players, accounting for over 80% of eCommerce sales in China at their peak |

| Over one billion people in China use their mobile devices for online shopping | |

| China's eCommerce market is largely characterized by social commerce, where products are sold directly through social media platforms like WeChat and Weibo | |

| Despite challenges like counterfeit products and data privacy concerns, the Chinese government's support for eCommerce development suggests continued success |

-

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

-

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

-

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

-

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

-

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

-

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

Global Payments

Insights Report

Ready to streamline your payment and payout processes?

Download our free Global Payments Insights

Report and discover how the latest trends - and big picture changes / strategies (not sure what word here) - can help you optimize your payment and payout strategy and operations.

Maximize your business potential in China with MassPay's localized solutions for payments and payouts

China's eCommerce market has experienced unprecedented growth in recent years, making it an attractive destination for businesses looking to expand internationally. However, entering the saturated Chinese market can be challenging, especially when it comes to payment and payout orchestration. Not to mention, stringent cybersecurity regulations can make it difficult for foreign companies to comply with local laws.

This is where MassPay's localized solutions come in—when they partner with MassPay, businesses gain access to a comprehensive suite of payment and payout solutions specifically designed to meet the unique requirements of the Chinese market.

Empowering Merchants in China’s Booming eCommerce and Fintech Landscape

China is a nexus of tradition and innovation that stands as an eCommerce titan. For businesses aiming to tap into this vast market, MassPay offers a streamlined gateway:

Smooth cross-border transactions to ease international trade with efficient currency conversions and regulatory adherence

Swift payout mechanism for everything from vendor payments to consumer refunds, for quick and hassle-free disbursements

Top-tier security with advanced protection measures to safeguards every transaction

With MassPay, stepping into China's dynamic eCommerce realm becomes not only feasible but also a strategic advantage.

Secure and reliable

technology

Security remains a top priority for businesses and consumers alike. MassPay’s integration and orchestration with critical providers in the region results in security and reliability our customers rely on. With MassPay's advanced fraud protection solutions, you can be confident critical data, payments and payouts are managed and processed securely.

Payout and payment

preferences (in local

currency)

Success in any market, especially China, is built upon a hyper-localized foundation. Successful organizations present to their customers, partners, employees, contractors, etc. not only in the local language(s) but also present the preferred local payment and payout options that reflect real-time values in the selected local currency(s).

Account for the leading mobile wallets / alternative payment and payout methods from Alipay, UnionPay, WeChatPay and more, and you have a complex ecosystem that requires detailed local knowledge to ensure success.

Optimized payment

processing

MassPay's solutions are optimized for the Chinese market, orchestrating a seamless payment experience without delays or disruption. This includes support for popular payment methods such as Alipay, UnionPay and WeChat Pay.

Forex

Offer customers in China more ways to pay by allowing them to pay with MassPay's Forex service. Businesses can also benefit from MassPay's competitive exchange rate and low transaction fees.

Payouts

MassPay orchestrates efficient payout options that work quickly and without hassle. This saves merchants time and money—it eliminates the need for manual processing or additional costs associated with third-party processors.

The Chinese

Payout Market

Success in China's payout market necessitates a payment strategy that caters to Chinese consumers' needs and simultaneously complies with stringent local regulations.

MassPay provides a seamless payment and payout experience in China, with fast and accurate payments for local partners. We make it easy to choose the best exchange rate and pay gig workers and team members how they prefer.

Chinese Payment Methods

Unlock China's lucrative eCommerce market with MassPay—our quick sign-up and easy integration mean you can be up and running in minutes. MassPay's localized Chinese payment and payout solutions make it easier than ever for businesses to take advantage of the world's largest eCommerce market. With a localized strategy built to the specifics of the Chinese market, you can offer customers their preferred payment and payout methods.

Global Payouts

Built for the Gig Economy.

Give your talent flexibility & full control of their funds with payouts on demand in 175+ countries & 70+ currencies.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including crypto.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Simplify Administration

Say goodbye to complexity. We take care of accounting & reconciliation details and more. You focus on growing your platform.

No More Tax Forms

Your talent is global. We take care of the 1099 & 1042 process for you. You focus on growing your platform.

Reward Your Talent

Help them grow their business.Incentivize quality and increase completion rates.Postdate payments until customers are happy.

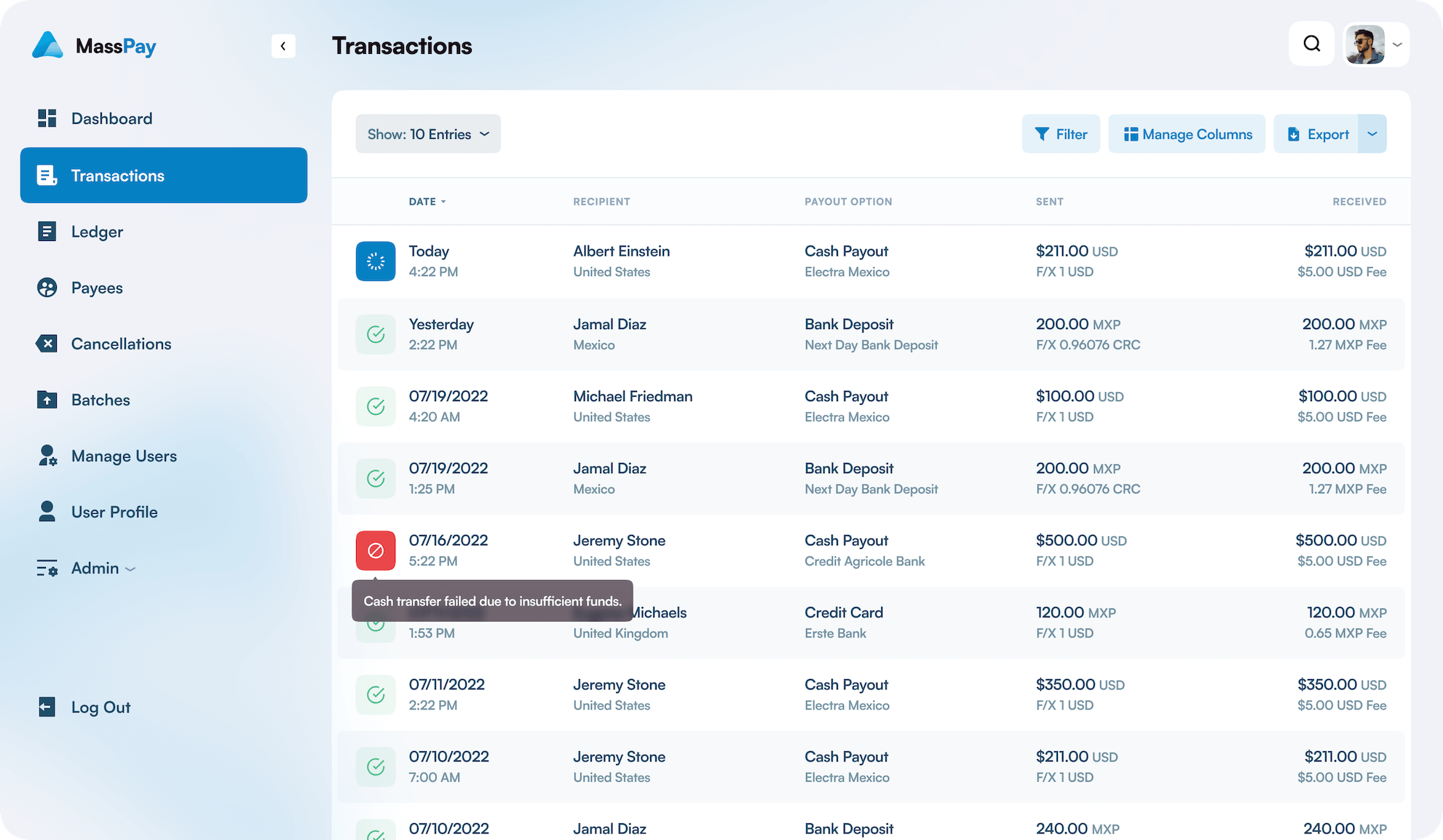

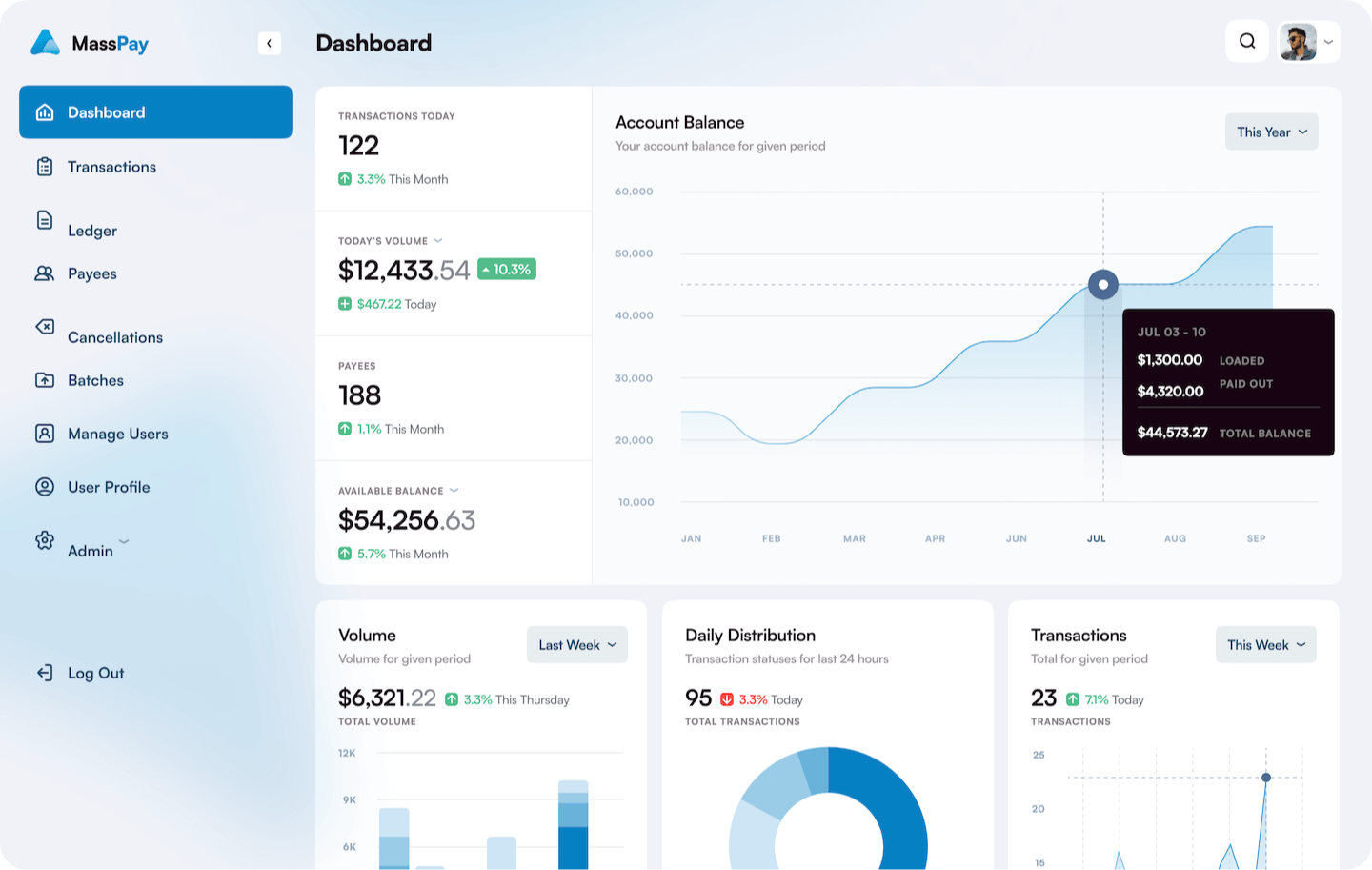

SINGLE PANE OF GLASS

FOR YOUR PAYOUT OPERATIONS

All of your payout operations are accessible from an easy to access, easy to use dashboard that is available wherever you are with whatever device(s) you prefer.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Mobile payments

![]()

![]()

A necessity in most markets, mobile payments are especially important in China as they account for over 70% of total online transactions. MassPay offers integrated solutions with Chinese payment providers such as Alipay, WeChat Pay, UnionPay, and more.

Credit and debit cards

![]()

![]()

Credit cards are China's second-most common payment method, accounting for about 21% of all transactions—second only to digital wallets. As of 2022, China had also issued over nine billion debit cards.

Bank transfers

![]()

![]()

MassPay's bank transfer solutions allow businesses to support payouts from China's major banks, including:

• Industrial and Commercial Bank of China (ICBC)

• China Construction Bank (CCB)

• Agricultural Bank of China (ABC)

• Bank of China (BOC)

Cross-border payments and remittances

![]()

There is a growing interest in cross-border payments and remittances among Chinese consumers. As China's economy grows and its citizens become more globalized, there is increasing demand for fast, secure, and cost-effective ways to send and receive money across borders.

Detailed Reporting

COMPREHENSIVE DATA

Immediate access to real-time reporting provides comprehensive visibility into your operations. No matter what you're looking for, or where you're looking for it, it's right at your fingertips.