The UK’s eCommerce industry is booming, with a compound annual growth rate of 8.43% between 2023-2027 and a projected market volume of US $230.40 billion by 2027. In fact, more people shop online in the UK than anywhere else in the world. With MassPay’s global payment and payout platform, you tap into the UK eCommerce market and easily access fast, reliable, and safe payment options around the world.

Capitalize on the UK’s eCommerce boom

Unlocking the UK eCommerce goldmine: seize opportunities in the booming online retail market

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| Revenue in the UK’s eCommerce market is projected to reach US$166.70 billion in 2023. | |

| As of 2023, the population of the United Kingdom sits at about 68 million. Of this number, 60 million are online shoppers, meaning only a small fraction of the entire population isn’t shopping online. | |

| eCommerce makes up an astonishing 26%+ of all retail sales in the United Kingdom. | |

| Sustainability and ethical considerations play an increasingly significant role in purchasing decisions—more consumers are concerned with supporting environmentally and socially responsible brands. |

| Ecommerce returns have become more common, with womenswear leading the way with a returns rate of 23%. Now, consumers view returns as a part of the shopping process. | |

| Europe leads the world in "Buy Now Pay Later" (BNPL) options, with 8% of UK eCommerce sales relying on instant loans. | |

| Payments in the UK (and the EU) have significantly transformed, with strong customer authentication (SCA) becoming a regulatory requirement in March 2022. | |

| Cross-border sales are rising, with UK, French, and Italian consumers purchasing from merchants outside their home countries. |

-

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

-

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

-

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

-

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

-

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

-

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

Capitalize on its potential while overcoming the challenges of the UK’s eCommerce market with MassPay

The UK eCommerce market faces rising costs, inflation, labor shortages, and supply chain disruptions. Merchants must build sustainable systems and marketplace strategies to thrive in the post-pandemic eCommerce landscape.

With MassPay’s solutions tailored to the UK eCommerce industry, you have instant access to global payment and payout options to meet the demands of local customers but also overcome the market’s challenges.

MassPay provides merchants robust fraud protection measures (including encryption and tokenization) and other features to meet ever-evolving customer demands while staying compliant in the UK’s eCommerce market.

Our global gateway ensures payments arrive on time and securely without delays or errors.

The UK’s Dynamic and Thriving eCommerce and Fintech Sector

Leveraging MassPay’s region-centric transaction prowess, UK merchants are perfectly positioned to engage with localized payment infrastructures, setting the stage for:

Additional revenue streams

Peak approval rates

From the heart of London or the furthest reaches of the globe, customers crave the ability to use their preferred local payment methods. These methods, when integrated seamlessly into the checkout process, elevate the overall shopping experience. This dedication to localized solutions and global scalability is precisely what MassPay delivers to the dynamic UK market.

Payout preferences (in local currency)

If you’re looking to pay out your earnings in the UK, MassPay can help you do so. Our payout platform provides businesses quick and easy access to local currencies supported in the UK.

Advanced payment processing options

Different types of customers require other payment methods—that’s why we offer a comprehensive portfolio of payment solutions that support alternative payment methods such as debit cards, credit cards, and even digital wallets.

Local and international redundancy

The United Kingdom is a highly regulated market, and MassPay helps merchants protect their data with local and international redundancies. Since 2022 when strong customer authentication (SCA) became a legal requirement in the UK, MassPay has been helping merchants stay compliant and secure with SCA-ready solutions.

Open banking

The UK has been at the forefront of open banking, allowing customers to share their financial data with authorized third-party providers securely. Open banking has encouraged competition, innovation, and the development of new financial products and services.

MassPay’s open banking API helps merchants access these resources and share customer data securely. It helps developers create payment recipients, send payments, and retrieve transaction details. In turn, they build better customer experiences, reduce costs, and boost efficiency.

Tokenization

MassPay’s tokenization process also helps merchants protect customer data with encryption. This allows them to easily manage customer payment data and confidently create secure transactions across different channels. This is more important than ever in the UK eCommerce market, where customers increasingly demand data privacy and security.

Digital payments

The UK has seen a significant shift towards digital payments, with fintech companies driving the adoption of mobile wallets, contactless payments, and peer-to-peer payment platforms. The rise of fintech payment providers has offered consumers and businesses convenient and efficient alternatives to traditional payment methods.

Now, eCommerce businesses need to choose payout and payment platforms—like MassPay—to streamline digital payments and offer secure solutions for customers.

The Payout Market in the United Kingdom

The payout market in the United Kingdom is a significant component of the financial landscape, and businesses must be able to meet customer needs to remain competitive. MassPay helps you navigate the complexities of the UK eCommerce market by providing an integrated solution for payouts, payments, and tokenization.

With MassPay, you can:

- Easily manage payments and transactions

- Protect customer data with encryption

- Accept a variety of local payment methods

- Ensure secure and reliable payments across different channels

- Comply with stringent data security and privacy laws

- Provide a seamless checkout experience

- Reap the rewards of a seamless experience for sending and receiving money

How the British Pay

No matter where in the world your business operates or has customers, meeting the unique local payment preferences is the key to success. MassPay supports various local payment methods—including cash, bank transfers, and mobile payments—offering you the flexibility to meet customer needs in the UK.

Global Payouts

Built for the Gig Economy.

Give your talent flexibility & full control of their funds with payouts on demand in 175+ countries & 70+ currencies.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including crypto.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Simplify Administration

Say goodbye to complexity. We take care of accounting & reconciliation details and more. You focus on growing your platform.

No More Tax Forms

Your talent is global. We take care of the 1099 & 1042 process for you. You focus on growing your platform.

Reward Your Talent

Help them grow their business.Incentivize quality and increase completion rates.Postdate payments until customers are happy.

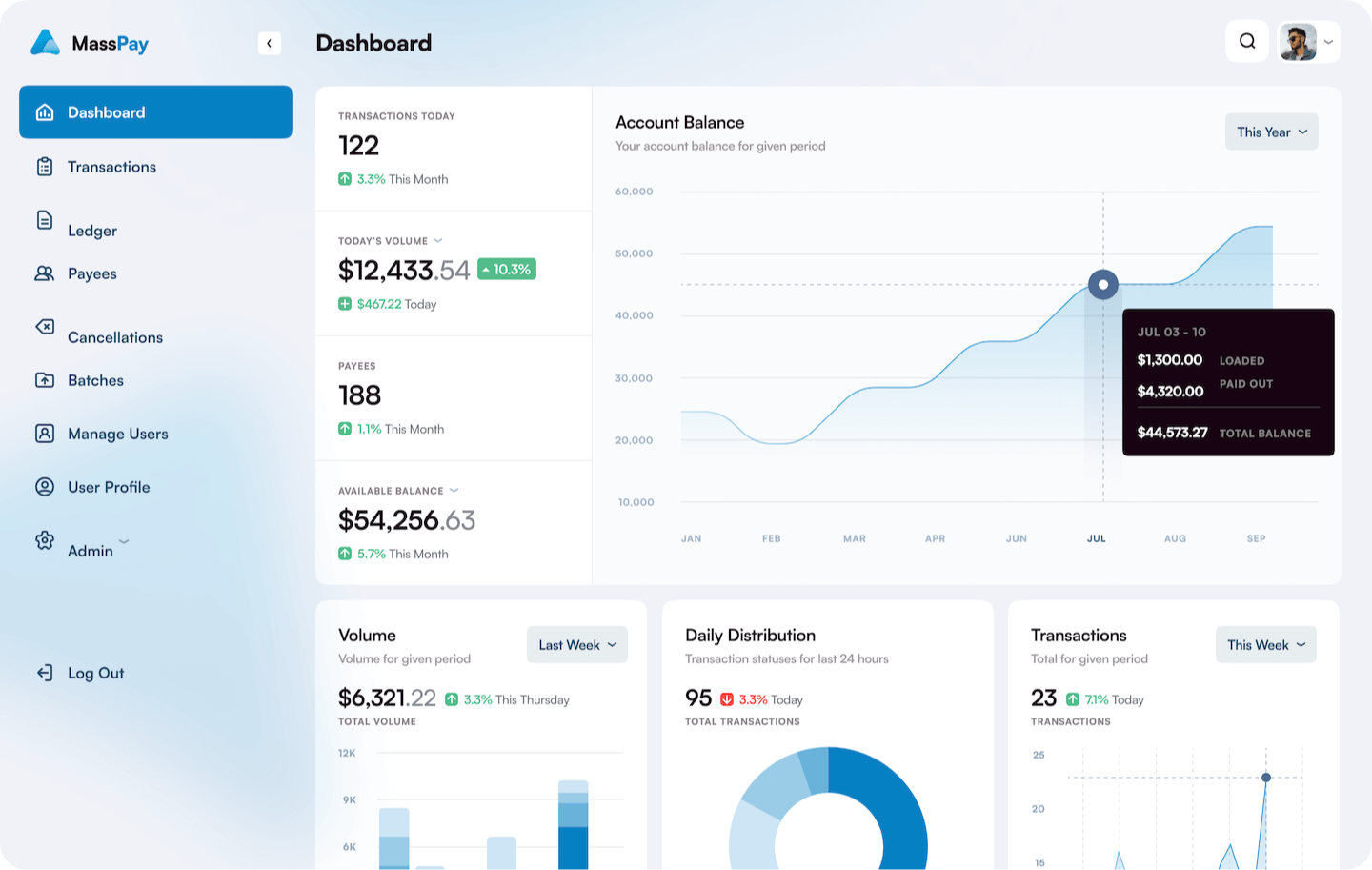

SINGLE PANE OF GLASS

FOR YOUR PAYOUT OPERATIONS

All of your payout operations are accessible from an easy to access, easy to use dashboard that is available wherever you are with whatever device(s) you prefer.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Debit cards

![]()

Debit cards are the most popular payment method in the UK—accounting for about half of all transactions. They are used to make purchases and withdraw cash directly from bank accounts, making them a convenient and secure option for customers.

Contactless payments

![]()

Contactless payment methods, such as contactless cards and mobile wallets, are widely used in the UK. The value of all contactless payments jumped 49.7% in 2022, and this trend is expected to continue.

Online payments

![]()

Online payments are increasingly popular in the UK—the vast majority of adults in the United Kingdom use online and mobile banking. People use various online payment platforms to purchase and transfer funds electronically.

Bank transfers

![]()

Bank transfers—or electronic funds transfers (EFTs)—are commonly used for transactions in the UK. Individuals and businesses use them to transfer funds directly from one bank account to another, which proves to be a fast and convenient option for many, including when they pay bills.

Cash

![]()

Although declining in popularity overall (in the UK and many other parts of the world), cash is still accepted and used for smaller transactions in the UK. For example, cash is often used for local shops, cafes, and public transportation purchases. However, in 2021, only about 15% of UK transactions took place in cash, expected to drop to 6% by 2031.