Mexico is quickly becoming a force to be reckoned with in the global eCommerce market. With a rapidly growing economy and a large and digitally-savvy population, the Mexican eCommerce industry’s room to grow is exciting. In 2022, Mexico's eCommerce sales grew by 23% and are expected to continue to rise in the coming years.

MEXICO: A RISING STAR IN GLOBAL ECOMMERCE.

Key statistics about Mexico's

growing eCommerce market

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over the age of six. | |

| Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments. | |

| Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem. |

| Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online. | |

| Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity. | |

| 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online. |

-

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

-

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

-

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

-

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

-

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

-

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

Global Payments

Insights Report

Ready to streamline your payment and payout processes?

Download our free Global Payments Insights

Report and discover how the latest trends - and big picture changes / strategies (not sure what word here) - can help you optimize your payment and payout strategy and operations.

Utilize MassPay's tailored payment and payout solutions designed for the Mexican market to optimize your business potential

Mexico's adoption of digital payments, eCommerce, and the sharing economy has proliferated in recent years, but it still lags behind a few larger global trends. MassPay provides hyper-localized payment solutions designed specifically for Mexican businesses, so you can overcome the challenges of conducting business in a diverse market like Mexico.

Our localized solutions—including cash pickup services as payouts—ensure consumers and businesses can pay and be paid in the best way for them. With secure, reliable, and cost-effective solutions, you maximize your business opportunities in Mexico.

MassPay bridges the gap between Mexico's digital and non-digital consumers, allowing businesses to optimize their potential.

Empowering Merchants in Mexico’s Booming eCommerce and Fintech Landscape

Hyper-localized payout solutions in Mexico are a must for entering the country’s eCommerce and fintech market.

Turn to solutions designed to meet the Mexican market’s unique needs:

Tap into the informal sector to bridge the formal and informal sectors (resulting in easier transaction flows and wider market penetration)

Catering to cash preferences in a country where cash is still king, MassPay helps businesses integrate cash payment options seamlessly

By opting for MassPay's specialized offerings, businesses can confidently anchor themselves in Mexico's flourishing fintech and eCommerce landscape, ensuring a harmonious blend of local tastes and global standards.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including Alternative Payment Methods.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Payouts

When merchants send payouts to their customers, they need to make sure they use the optimal method for their market. Accounting for Mexico's cash-based economy, you have quick payout options that use local payment methods.

Secure and reliable technology

Many Mexicans have concerns surrounding the security of online payments and sharing their banking information. In a 2022 study, 42.4% of Mexican online users reported feeling doubtful about how companies used their data, and 53.6% were concerned about distinguishing what was real or fake on the internet.

To address this, MassPay utilizes industry-leading encryption and authentication protocols to ensure the secure transfer of payments and payouts. Our security measures give your Mexican customers extra assurance as they make digital transactions with you.

The Mexican

Payout Market

To succeed in the diverse Mexican payout market, merchants must understand the local payment infrastructure. Leverage our expertise in the Mexican payments industry, optimize your customer experience, and maximize your success.

With capabilities that support leading payment and payout options and secure technology to ensure the safe transfer of funds, it’s easy for Mexican customers to pay and be paid. With MassPay, merchants can focus on their core business operations while we take care of the rest.

Payout Options in Mexico

To provide Mexican customers with suitable payout options that meet their needs and preferences, choose from hyper-localized payment solutions.

Global Payouts

Built for the Gig Economy.

Give your talent flexibility & full control of their funds with payouts on demand in 175+ countries & 70+ currencies.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including crypto.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Simplify Administration

Say goodbye to complexity. We take care of accounting & reconciliation details and more. You focus on growing your platform.

No More Tax Forms

Your talent is global. We take care of the 1099 & 1042 process for you. You focus on growing your platform.

Reward Your Talent

Help them grow their business.Incentivize quality and increase completion rates.Postdate payments until customers are happy.

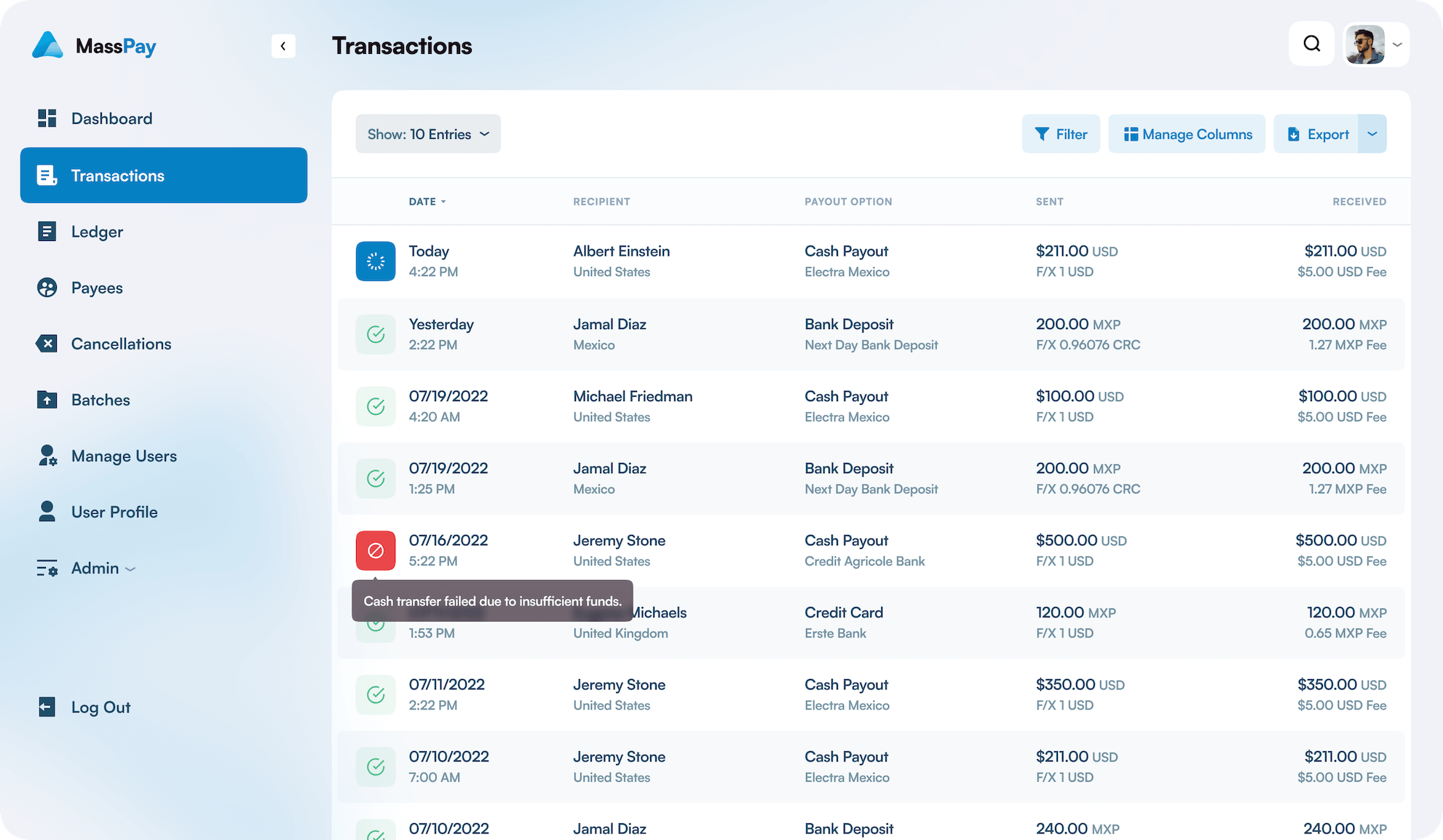

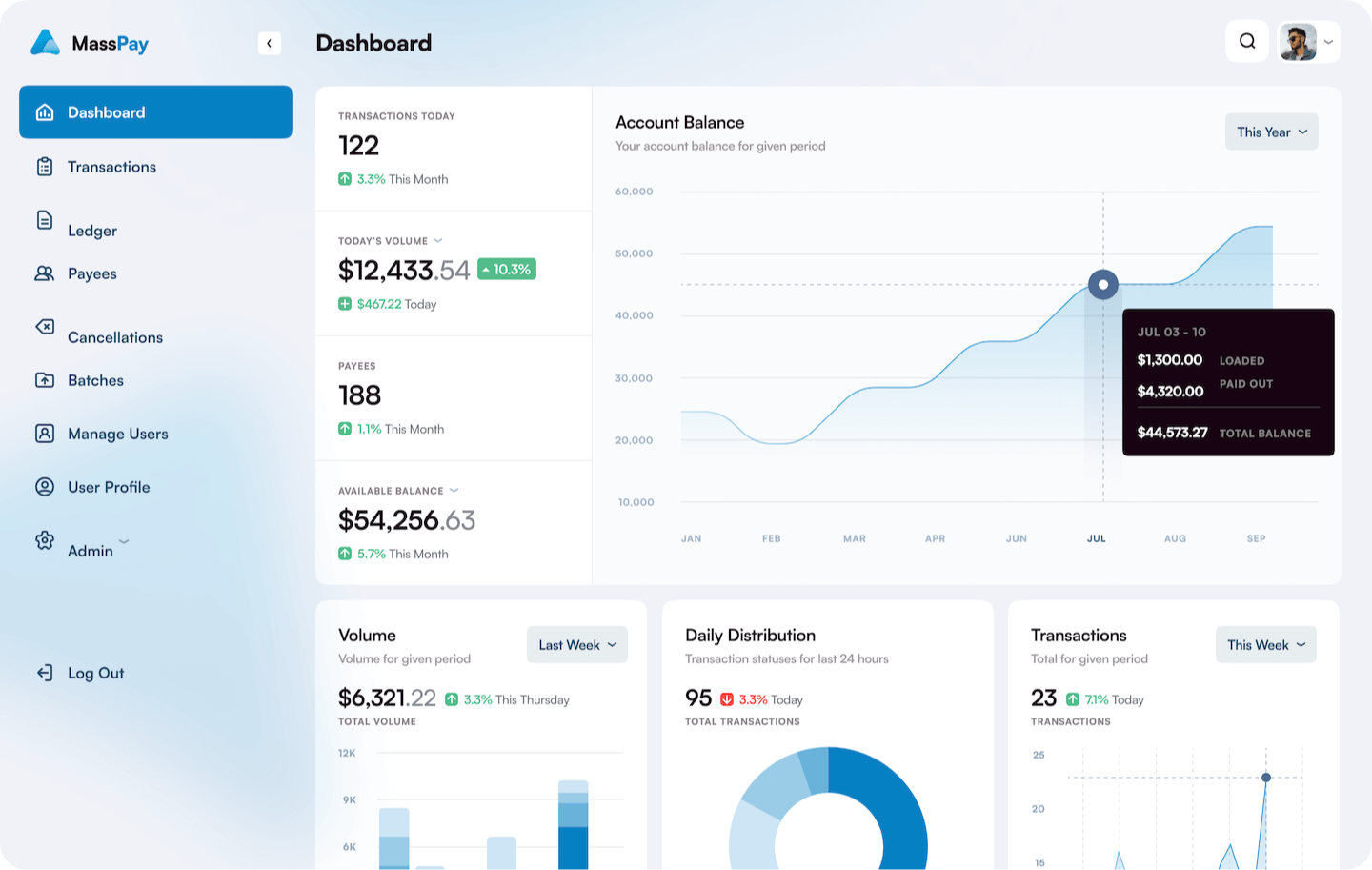

SINGLE PANE OF GLASS

FOR YOUR PAYOUT OPERATIONS

All of your payout operations are accessible from an easy to access, easy to use dashboard that is available wherever you are with whatever device(s) you prefer.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Cash and cash pickup services

![]()

Cash remains king when it comes to payment methods in Mexico. With a network of affiliated banks and money transfer services, merchants can use fast and secure cash pickup services as payouts, helping them reach their customers regardless of where they're located.

Credit and debit cards

![]()

![]()

Credit/debit card payments are also popular in Mexico, and MassPay supports leading cards, including MercadoPago and Oxxo Pay. With ultra-secure technology, customers can pay with their credit/debit card in a single click.

Alternative payment methods

![]()

Beyond cash and credit/debit cards, you’ll have support for alternative payment methods such as bank transfers, prepaid cards, e-wallets, and more. We make it easy for Mexican customers to choose their preferred payment method and optimize the checkout process.

Cross-border payments and remittances

![]()

Another crucial component of Mexico's financial ecosystem is cross-border payments and remittances. In fact, as of 2023, Mexico now receives more remittances than China (valuing about around $60bn in 2022).

Many Mexican citizens who work in the US send money back home. However, one challenge associated with cross-border payments is lower authorization rates if domestic cards aren’t enabled for international transactions.

Detailed Reporting

COMPREHENSIVE DATA

Immediate access to real-time reporting provides comprehensive visibility into your operations. No matter what you're looking for, or where you're looking for it, it's right at your fingertips.