Brazil dominates the eCommerce market in Latin America, with an expected increase in eCommerce revenue development of 25% in 2023. Tap into this unprecedented potential with MassPay's payout solutions tailored to the needs of Brazilian shoppers.

Tap into the potential of Brazil's eCommerce market

Brazil's eCommerce revolution: financial inclusion & connectivity fuel market dominance

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| Boasting the largest online population in all of Latin America, nearly 173 million people in Brazil have internet connectivity as of 2023 | |

| 75% of the Brazilian population used a smartphone in 2021—projections show the smartphone market penetration rate surging to 84.2 % by 2026 | |

| Brazilians favor international eCommerce brands over domestic ones, underscoring the need for multi-currency payment options |

| Brazil leads FinTech in Latin America and ranks 5th globally with 1,289 startups. Investment surged from $52M in 2015 to $4.5B in 2022. | |

| The Central Bank reports an estimated 36 million unbanked people in Brazil, but this number has dropped dramatically in recent years | |

| Brazil's enthusiastic adoption of digital payments is notable despite its cash-based culture |

-

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

-

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

-

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

-

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

-

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

-

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

Global Payments

Insights Report

Ready to streamline your payment and payout processes?

Download our free Global Payments Insights

Report and discover how the latest trends - and big picture changes / strategies (not sure what word here) - can help you optimize your payment and payout strategy and operations.

Meet the Needs of the

Brazilian eCommerce Market

Brazil, with its pulsating rhythms, vast landscapes, and dynamic economic growth, stands as a beacon in the global fintech landscape. To truly harness the potential of this South American giant, MassPay offers a suite of tailored solutions:

Real-time transaction processing to guarantee rapid payment processing

Optimized currency operations for seamless currency conversions and optimal rates

Robust security protocols that integrate cutting-edge protection measures to safeguard every transaction and build trust with users

When they leverage MassPay's specialized offerings, businesses are poised to thrive, innovate, and expand in the heart of Brazil's burgeoning fintech sector.

payout preferences

(in local currency)

With MassPay's Brazilian payment solution, merchants can pay in their preferred currency. This gives merchants the flexibility to choose between the payment options that serve their customers better while reducing the cost of foreign exchange transactions.

Local and international

redundancy

Our Brazilian payment solution is equipped with localized support, access to local banking networks, and secure processing. This allows merchants to operate in Brazil without worrying about reliability or security issues.

Payouts

MassPay offers fast payout options that help customers get paid quickly and without hassle. This helps merchants save time and money by eliminating the need for manual processing or additional costs associated with third-party processors.

payment processing

Our secure Brazilian payment processing network is designed to protect merchant data and ensure fast and reliable transaction processing.

Cash payout partners

Turn to MassPay for easy access to local cash payout partners. Our network of partners allows merchants to pay out in a preferred currency and provides customers with more ways to get paid.

Forex

MassPay's Brazilian payment solution offers Forex features to allow merchants to make real-time exchange rate conversions, ensuring they get the best rates possible. Merchants save time and money while ensuring they have the most up-to-date currency data.

Now that more Brazilians are ready to pay with digital payments, the opportunity for merchants to gain traction in this market is higher than ever. The challenge, however, is finding a payment solution to provide secure local access and smooth transactions.

MassPay's Brazilian payment solution offers an array of features designed to meet domestic and international merchant needs. Our local Brazilian payment solution provides merchants with the localized support, access to local banking networks, and secure processing needed to succeed in this rapidly growing market.

How Brazilians Pay

Creating a localized payment strategy that caters to Brazilian customers helps businesses expand their customer base and tap into the lucrative Brazilian payout market. When they accept popular Brazilian payment methods, businesses can provide customers with the speed and convenience they demand when making payments.

Comply with stringent local rules and regulations when paying local Brazilian suppliers

Enjoy a seamless experience for both sending and receiving money

Local partners receive payments quickly and accurately

Choose the best exchange rate for sending money between USD and BRL or other currencies

The Brazilian Payout Market

Today, Brazilians are more comfortable paying online, but alternative payments remain popular nationwide. As a result, businesses must create a localized payment strategy that caters to their customers' needs. With effective local payment strategies, businesses open new revenue opportunities and tap into the Brazilian payout market. Pay gig workers and other team members how they want to be paid with MassPay.

Global Payouts

Built for the Gig Economy.

Give your talent flexibility & full control of their funds with payouts on demand in 175+ countries & 70+ currencies.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including crypto.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Simplify Administration

Say goodbye to complexity. We take care of accounting & reconciliation details and more. You focus on growing your platform.

No More Tax Forms

Your talent is global. We take care of the 1099 & 1042 process for you. You focus on growing your platform.

Reward Your Talent

Help them grow their business.Incentivize quality and increase completion rates.Postdate payments until customers are happy.

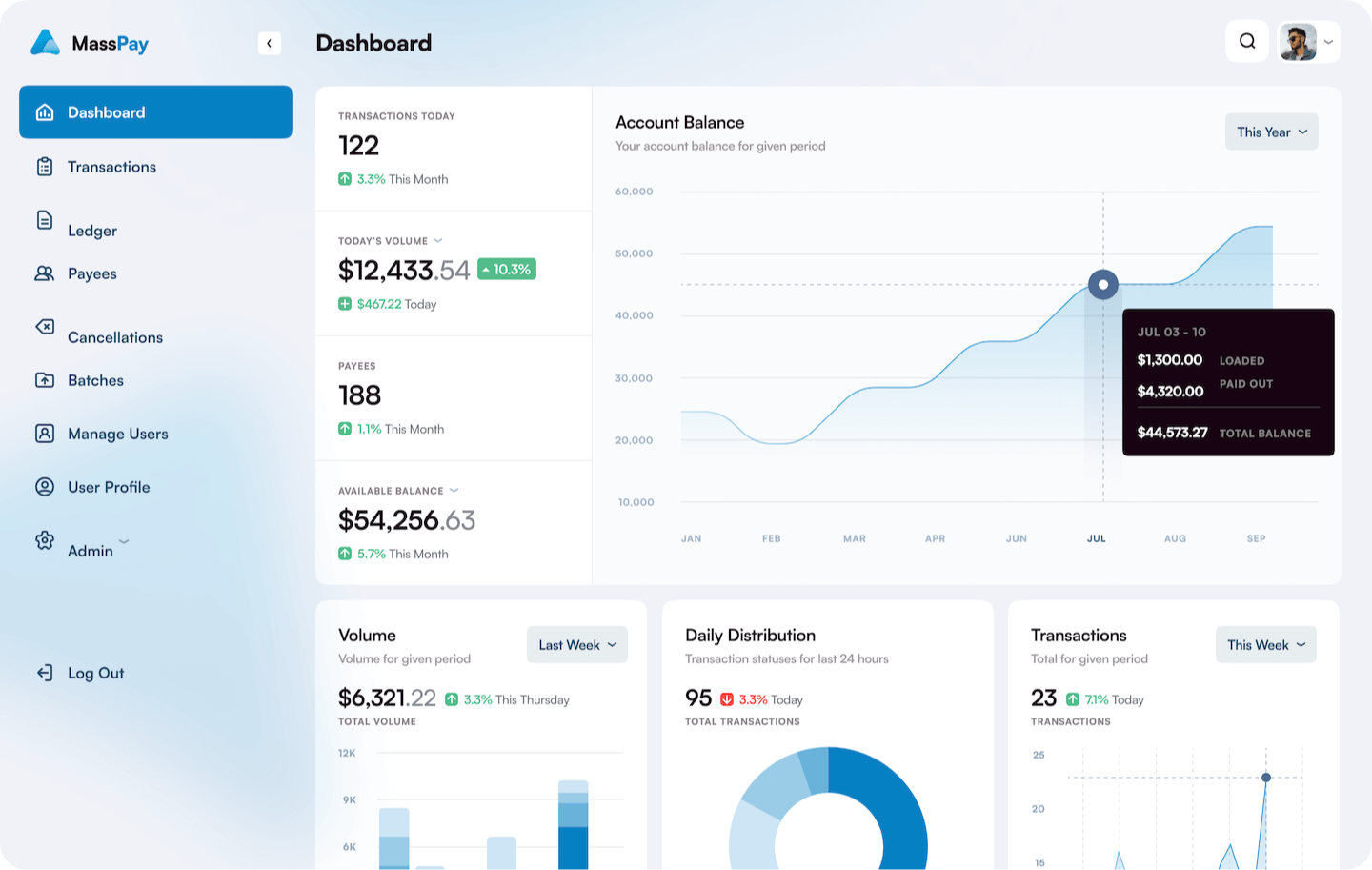

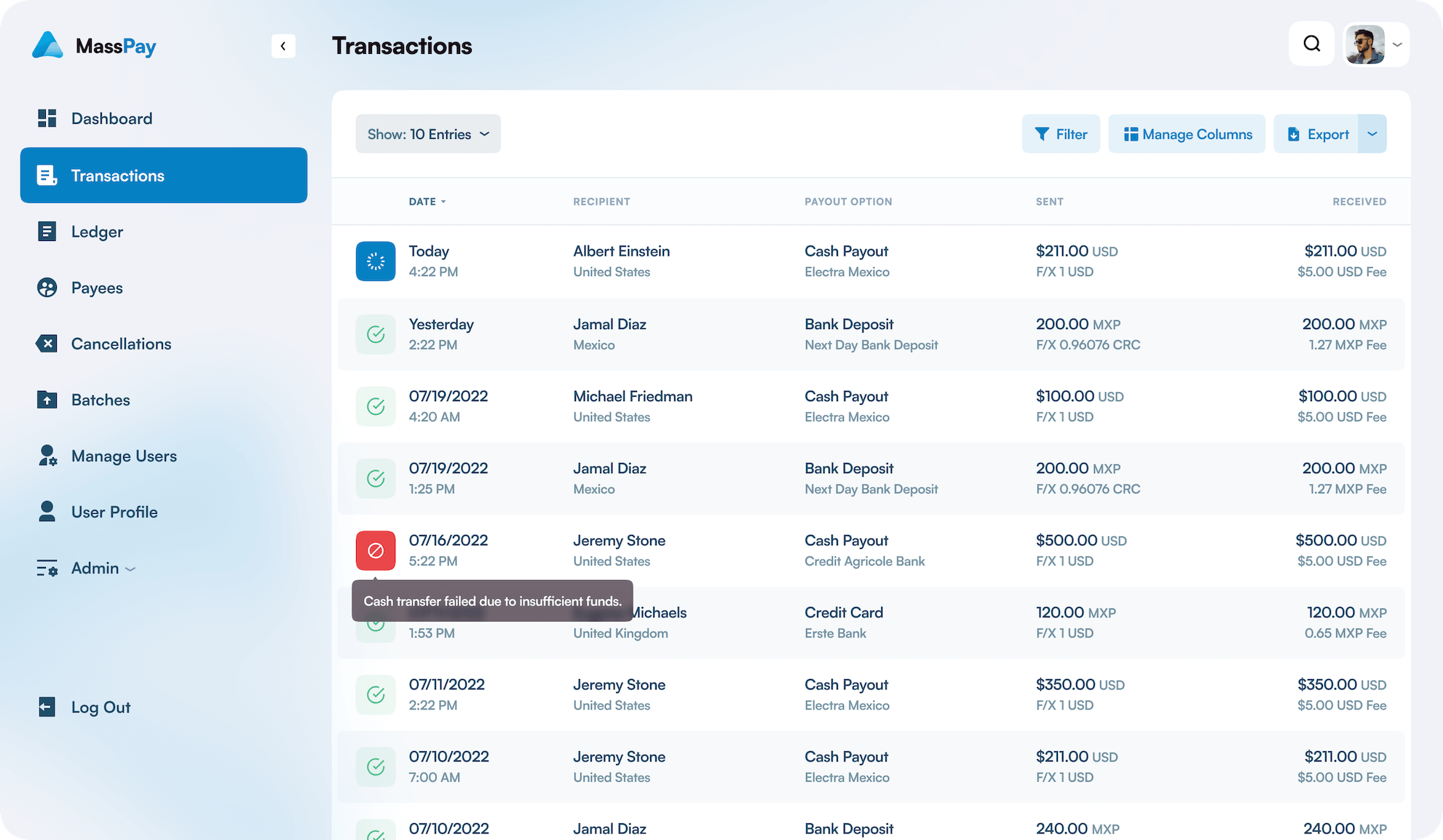

SINGLE PANE OF GLASS

FOR YOUR PAYOUT OPERATIONS

All of your payout operations are accessible from an easy to access, easy to use dashboard that is available wherever you are with whatever device(s) you prefer.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Boleto

![]()

![]()

This popular payment method in Brazil allows customers to pay for goods and services using cash or any other payment instrument at ATMs, convenience stores, banks, and post offices. Customers can also scan the barcode on their Boleto with their smartphone's camera and complete their purchase quickly. If your eCommerce store accepts Boleto, customers won't need to worry about using their credit cards.

Local Credit Cards

![]()

![]()

Local credit cards remain a popular payment method in Brazil. Now, online stores must ensure they can accept cards from major Brazilian banks, such as Itaú, Banco do Brasil, and Bradesco to accommodate their customers.

Local Debit

![]()

![]()

Brazilian customers also have the option to pay with local debit cards, which are accepted at most merchants in the country. For online merchants, accepting local debit cards simplifies checkout and allows customers to pay quickly with their preferred payment method.

Digital Wallets

![]()

![]()

Brazilians have eagerly adopted digital payment methods, including digital wallets. When your store allows customers to pay with digital wallets, such as MercadoPago and PicPay, you open up a larger customer base and increase sales opportunities.

Hipercard

![]()

![]()

Hipercard, founded in 1969, is one of Latin America's largest credit card issuers. It's a popular payment method for Brazilian customers who can use it for online and offline purchases. Accepting Hipercard can increase customers' confidence in making purchases from your store.

Detailed Reporting

COMPREHENSIVE DATA

Immediate access to real-time reporting provides comprehensive visibility into your operations. No matter what you're looking for, or where you're looking for it, it's right at your fingertips.

APM Penetration

As Alternative Payment Methods (APMs) gains popularity in Brazil, businesses should consider accepting Bitcoin, Ethereum, and other APMs to tap into the growing market and provide secure payment options.

Brazil's President has recently approved a APM regulation bill imposing penalties for fraud involving virtual assets and introducing licensing requirements for digital asset companies.

The law differentiates between digital assets considered securities, subject to supervision by the Brazilian Securities and Exchange Commission (CVM), and those overseen by a new regulatory body.