Between 2023 and 2027, the Colombian digital payments market is expected to grow by more than 10%. By the end of 2027, it will have a total estimated value of US $21.70 billion compared to its predicted value of US $14.65 billion in 2023. With its most significant market being digital commerce, this demonstrates the exciting potential for businesses hoping to enter or grow in the Colombian digital payments market.

UNLOCK DIGITAL COMMERCE OPPORTUNITIES IN COLOMBIA

Colombia’s unique eCommerce industry: cards are king in the Colombian payouts and payment market

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| Colombians have excitedly adopted digital payment solutions in recent years, and increasing internet and smartphone penetration leads to even more opportunities for businesses in the digital payments market. | |

| Card payments remain the primary payment method for eCommerce purchases in Colombia, with over half of Colombians choosing this method for transactions. | |

| Cards are not only a popular payment method in Colombia but also remain the primary online payment method in all of Latin America. | |

| Bank transfers and digital wallets had lower popularity among Colombians. They account for 18% and 13% of online checkouts, respectively. |

| Colombia is the third-largest FinTech hub in Latin America after Brazil and Mexico. | |

| Cross-border commerce in industries like gaming, online retail, streaming, and SaaS is increasing in Latin America, proving to be a powerful growth engine in Colombia. | |

| Colombia’s eCommerce market is forecasted to see a two-percentage-point increase in user penetration between 2023 and 2027, reaching a new peak of 54.03 percent. The market has been experiencing steady growth in user penetration over the past years, with four consecutive years of expansion. | |

| Smartphones are becoming the primary mode of connectivity for consumers, emphasizing the need for eCommerce platforms to optimize their mobile experience. |

-

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

-

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

-

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

-

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

-

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

-

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

Unlock eCommerce opportunities in Colombia with MassPay’s localized payment solution

With more Colombians engaging in digital commerce, businesses have the opportunity to unlock the full potential of Colombia’s payments market. MassPay’s payment gateway is designed with local Colombian customers in mind. It offers an easy-to-integrate solution for businesses looking to enter or expand their presence in Colombia’s eCommerce industry.

With an impressive variety of features and robust payment solutions, MassPay makes it easier for businesses to transact with local customers and increase their sales. MassPay’s fraud prevention system ensures the safety of transactions and helps companies protect their customers’ data. MassPay also offers checkout optimization and multi-currency support, allowing businesses to accept payments in multiple currencies and deliver their customers the best possible user experience.

MassPay is the perfect choice for businesses looking to unlock digital commerce opportunities in Colombia. The platform allows companies to efficiently launch their services in Colombia and engage in the growing payments market. With our localized payment solution, businesses can process payments quickly and securely while accessing various payment methods in over 70 currencies.

Empowering Merchants in Colombia’s Booming eCommerce and Fintech Landscape

With MassPay's localized transaction processing tailored for the Colombian market, merchants can efficiently work with in-country payment processors. In turn, Colombia entrepreneurs and businesses enjoy:

A higher conversion rate

Enhanced revenue potential

Whether in Colombia or on a different continent altogether, customers seek familiar local payment methods smoothly integrated into the checkout journey—MassPay provides exactly this experience for the Colombian audience.

Payout preferences (in local currency)

Colombian customers prefer to be paid out in the local currency, which is why our platform supports different payout methods that allow businesses to send payments in Colombian Pesos. This is especially important for businesses offering services or goods in Colombia that must pay out their affiliates or vendors in local currency.

Payment processing

MassPay offers advanced payment processing to secure merchant accounts, providing insights into customer behavior and data for optimal fraud prevention. Our platform also allows businesses to accept payments from all major debit and credit cards, digital wallets, bank transfers, and other alternative methods in Colombia.

Payouts in Colombia

With MassPay, businesses can make payouts to their Colombian customers securely and on time. Our platform makes international payouts easy with our streamlined process and convenient payout options.

Regulatory compliance

The Colombian government is actively strengthening financial regulations, enhancing consumer protection, and implementing measures to combat money laundering and improve cybersecurity. They also strive to ensure compliance with anti-fraud and data privacy regulations, requiring businesses engaged in payouts to stay informed and implement necessary safeguards.

MassPay is committed to helping businesses comply with the latest regulations in Colombia. Our platform supports KYB, AML/CTF processes, and GDPR compliance to ensure customers’ data safety and privacy. MassPay also helps businesses comply with local tax laws by providing accurate tax filing solutions.

Local and international redundancy

To ensure the highest level of reliability, MassPay offers local and international redundancy for businesses to back up their payments. When businesses have the confidence their payments will always be reliable and secure, they can focus on high-leverage tasks that help them reach their growth goals.

Forex tools

With Colombian payment solutions tailored to meet the needs of businesses in this region, MassPay also offers Forex tools to ensure merchants get the best exchange rates. Access to real-time currency data saves businesses time and money while ensuring they receive accurate currency conversions.

The Colombian Payout Market

As quickly as it’s growing, the Colombian payout market isn’t without its challenges. These include infrastructure and connectivity challenges, limited access to banking services, navigating strict compliance regulations, and security risks.

MassPay’s Colombian payment and payout platform equips merchants with the tools and resources they need to overcome these challenges and enter this potentially lucrative market. With our reliable services, businesses can enjoy fast and secure payments compliant with all local regulations.

Our comprehensive suite of features helps merchants stay ahead of the curve in their respective industries:

- Instant access to the world’s most extensive mass payout network.

- Facilitation of global payouts with a wide selection of currencies and payout methods.

- Three easy steps for global payouts.

- One-time Know Your Business (KYB) process for accessing payout possibilities.

- The ability to execute payouts in 175+ countries and markets and 70+ currencies, including APMs.

- Choose between the White Label Portal or API integration.

- Intelligent global routing and unmatched expertise for expanding reach.

Sign up today and join the fastest-growing payout orchestration platform on the planet.

How Colombians Pay

The Colombian payout market is constantly evolving due to the changing customer preferences and increased uptake of digital payments. MassPay’s Colombian payment solution offers a variety of payment methods that meet the diverse needs of customers in this region.

Global Payouts

Built for the Gig Economy.

Give your talent flexibility & full control of their funds with payouts on demand in 175+ countries & 70+ currencies.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including crypto.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Simplify Administration

Say goodbye to complexity. We take care of accounting & reconciliation details and more. You focus on growing your platform.

No More Tax Forms

Your talent is global. We take care of the 1099 & 1042 process for you. You focus on growing your platform.

Reward Your Talent

Help them grow their business.Incentivize quality and increase completion rates.Postdate payments until customers are happy.

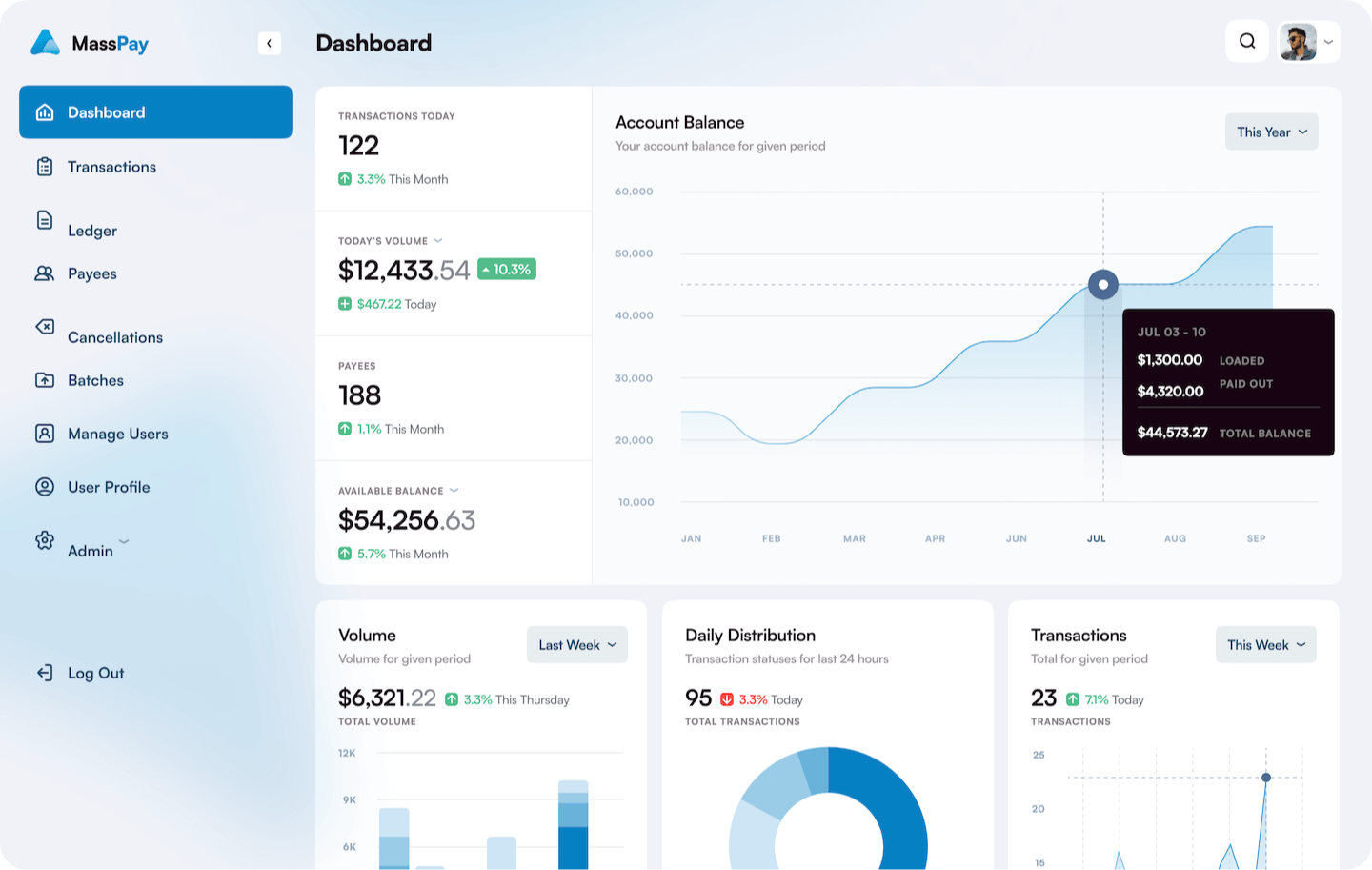

SINGLE PANE OF GLASS

FOR YOUR PAYOUT OPERATIONS

All of your payout operations are accessible from an easy to access, easy to use dashboard that is available wherever you are with whatever device(s) you prefer.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Cards

![]()

We know cards are the top payment choice in Colombia—over half of all Colombians use cards for eCommerce transactions over any other option. That’s why we provide a comprehensive suite of payment options that support all major debit and credit cards.

Digital wallets

![]()

MassPay also supports various digital wallets, including Apple Pay, Google Pay, and other commonly used mobile wallets in the region. The use of digital wallets in Colombia and throughout Latin America is on the rise, so it’s important for your payment and payout platform to support them.

Bank transfers

![]()

For customers who prefer traditional banking methods, MassPay offers bank transfer solutions to send payments securely and quickly without added costs.

PSE (Pagos Seguros en Línea)

![]()

Among the payment apps Colombians use, PSE stands out from the crowd. PSE is a widely used online payment method in Colombia, allowing customers to make secure payments directly from their bank accounts.

PSE integrates with various Colombian banks, helping users initiate transactions through online platforms or mobile apps. Users often rely on it for eCommerce purchases, utility bill payments, and other online payments.